-

OBP

- ABAC_Object_Properties_Reference

- ABAC_Parameters_Summary

- ABAC_Simple_Guide

- ABAC_Testing_Examples

- API

- API Collection

- API Tag

- API-Explorer-II-Help

- API.Access Control

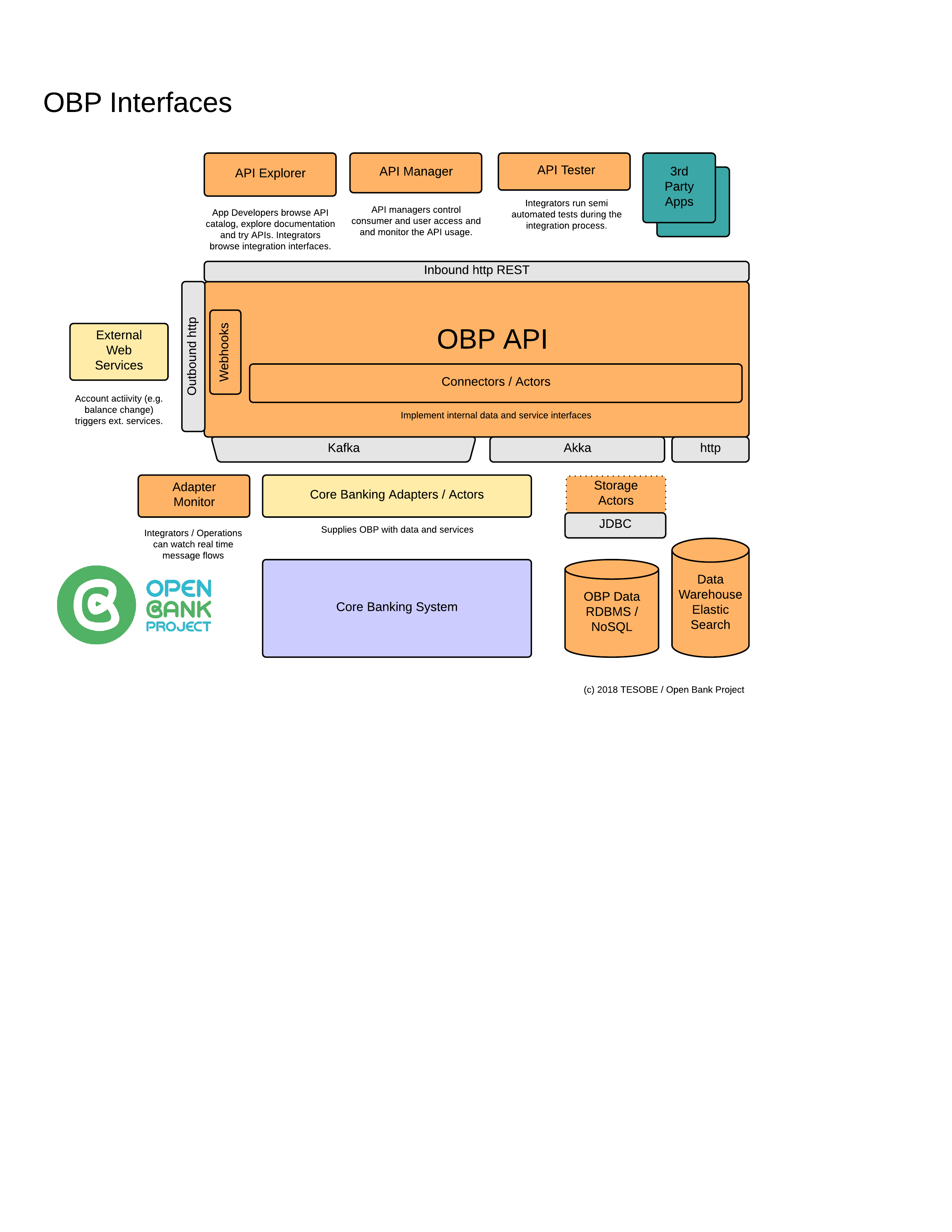

- API.Interfaces

- API.Timeouts

- API.correlation_id

- ATM.atm_type

- ATM.attribute_id

- ATM.balance_inquiry_fee

- ATM.branch_identification

- ATM.cash_withdrawal_international_fee

- ATM.cash_withdrawal_national_fee

- ATM.has_deposit_capability

- ATM.is_accessible

- ATM.located_at

- ATM.location_categories

- ATM.minimum_withdrawal

- ATM.name

- ATM.notes

- ATM.services

- ATM.site_identification

- ATM.site_name

- Account

- Account Access

- Account.account_id

- Account.account_routing_address

- Account.account_routing_scheme

- Account.iban

- Account.owner

- Account.queryTagsExample

- Adapter.Akka.Intro

- Adapter.Stored_Procedure.Intro

- Adapter.authInfo

- Adapter.brand

- Adapter.card_attribute_id

- Adapter.card_attribute_name

- Adapter.card_attribute_value

- Adapter.card_id

- Adapter.card_number

- Adapter.card_type

- Adapter.cbsToken

- Adapter.cvv

- Adapter.expiry_month

- Adapter.expiry_year

- Adapter.issue_number

- Adapter.key

- Adapter.limit

- Adapter.name_on_card

- Adapter.offset

- Adapter.provider_id

- Adapter.serial_number

- Adapter.value

- Adaptive authentication

- Age

- Agent.agent_id

- Agent.agent_number

- ApiCollection.apiCollectionId

- ApiCollection.apiCollectionName

- ApiCollectionEndpoint.apiCollectionEndpointId

- ApiCollectionEndpoint.operationId

- Attribute.name

- Attribute.type

- Attribute.value

- Authentication

- Authentication Device (AD)

- Authentication.provider

- Authorization

- Available FAPI profiles

- Bank

- Bank.bank_id

- Bank.bank_id

- Bank.bank_routing_address

- Bank.bank_routing_scheme

- Branch

- Branch.branch_id

- Branch.branch_routing_address

- Branch.branch_routing_scheme

- CIBA

- CRL

- ChallengeAnswer.challengeId

- ChallengeAnswer.hashOfSuppliedAnswer

- ChallengeAnswer.suppliedAnswerExample

- Cheat Sheet

- Connector

- Connector Method

- ConnectorMethod.connectorMethodId

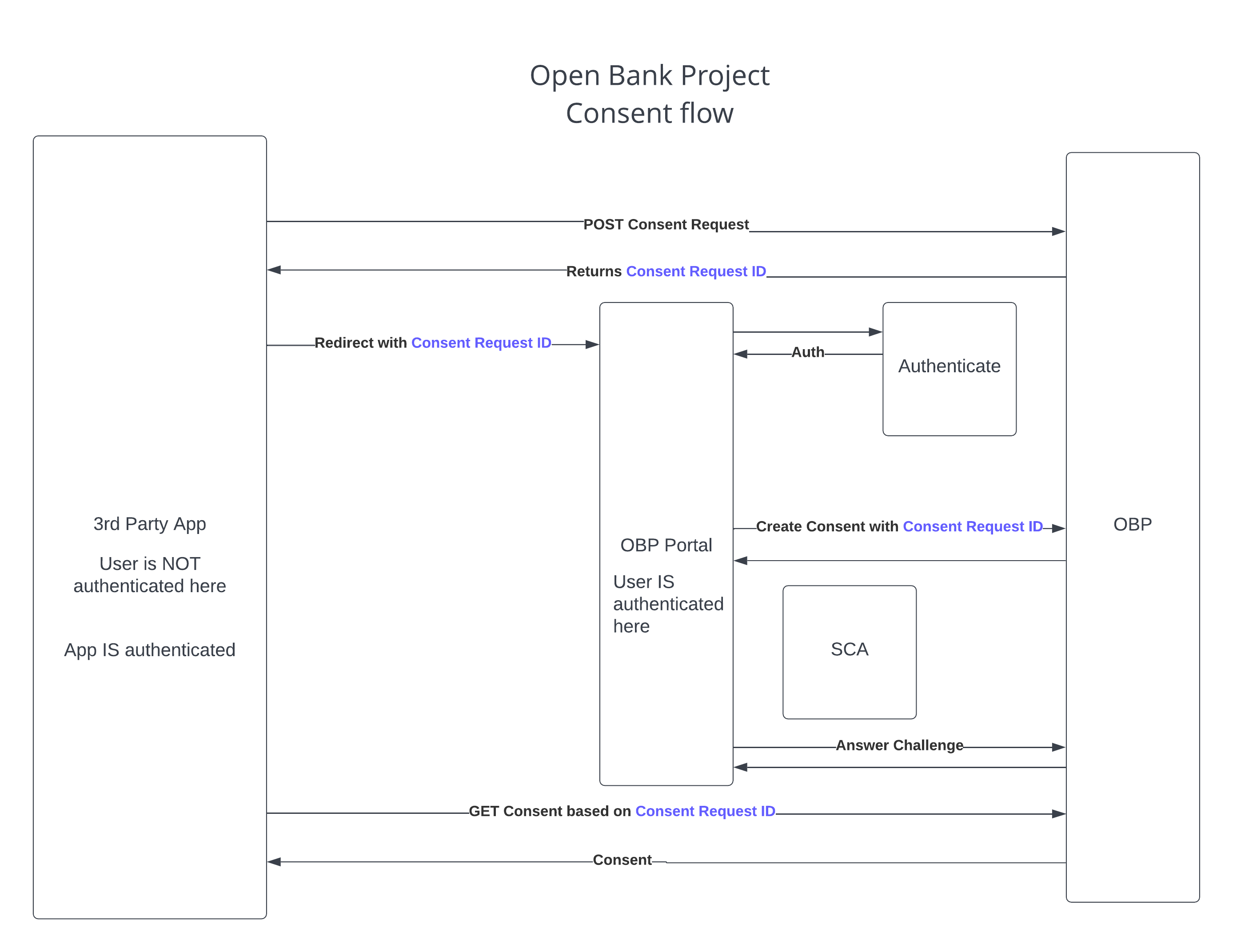

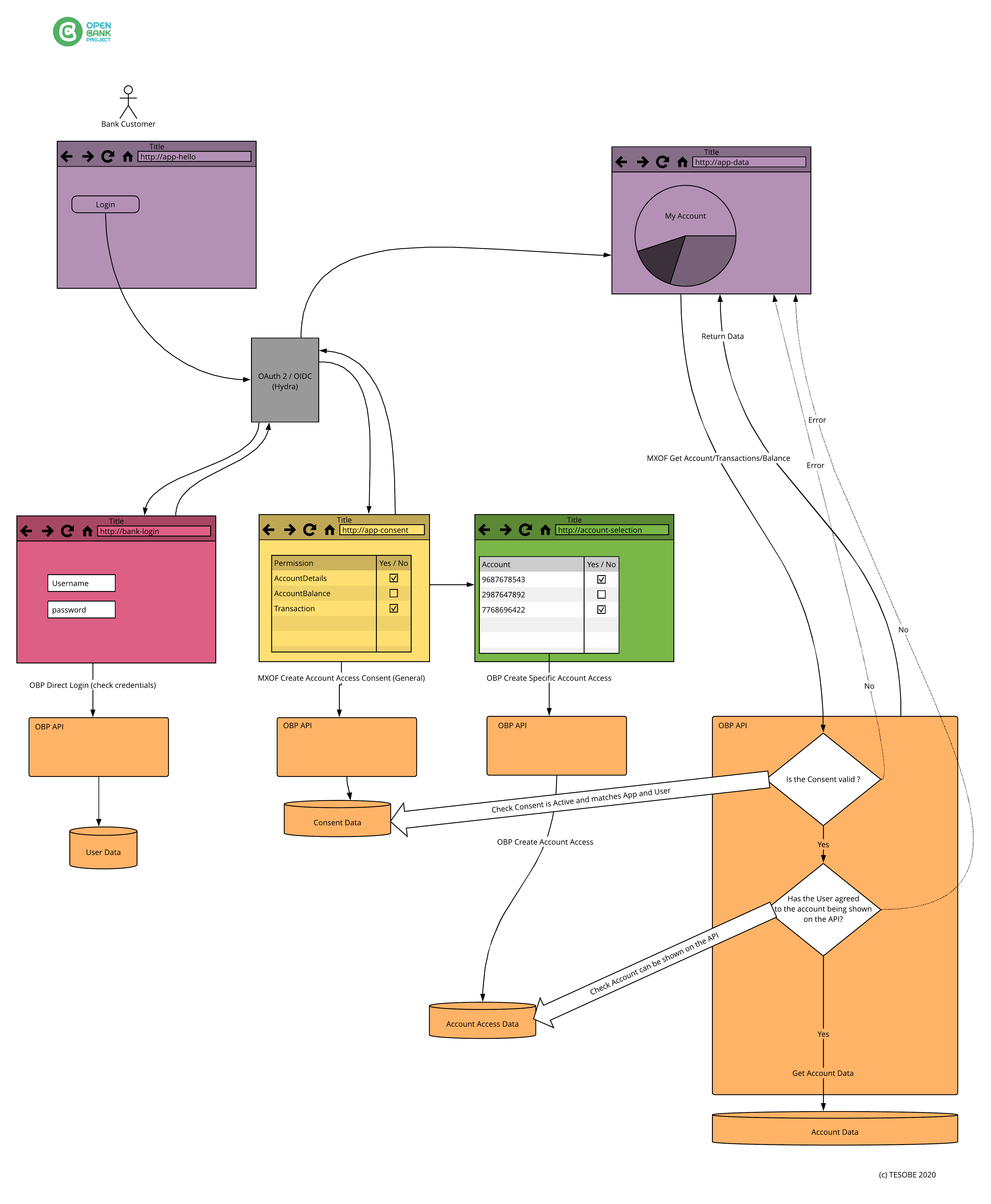

- Consent

- Consent_Account_Onboarding

- Consent_OBP_Flow_Example

- Consumer

- Consumer, Consent, Transport and Payload Security

- Consumer.consumer_key (Consumer Key)

- Consumption Device (CD)

- Counterparties

- Counterparty-Limits

- Counterparty.counterpartyId

- Counterparty.counterpartyName

- Counterparty.isBeneficiary

- Cross-Device Authorization

- Customer

- Customer.Credit.rating

- Customer.Credit.source

- Customer.attributeAlias

- Customer.attributeId

- Customer.attributeId

- Customer.attributeName

- Customer.attributeType

- Customer.attributeValue

- Customer.consumerId

- Customer.customerAccountLinkId

- Customer.customerAttributeId

- Customer.customerAttributeName

- Customer.customerAttributeType

- Customer.customerAttributeValue

- Customer.customerId

- Customer.customerNumber

- Customer.customer_id

- Customer.dependants

- Customer.dependents

- Customer.employmentStatus

- Customer.highestEducationAttained

- Customer.key

- Customer.kycStatus

- Customer.legalName

- Customer.mobileNumber

- Customer.nameSuffix

- Customer.relationshipStatus

- Customer.relationshipType

- Customer.secret

- Customer.title

- Customer.url

- DAuth

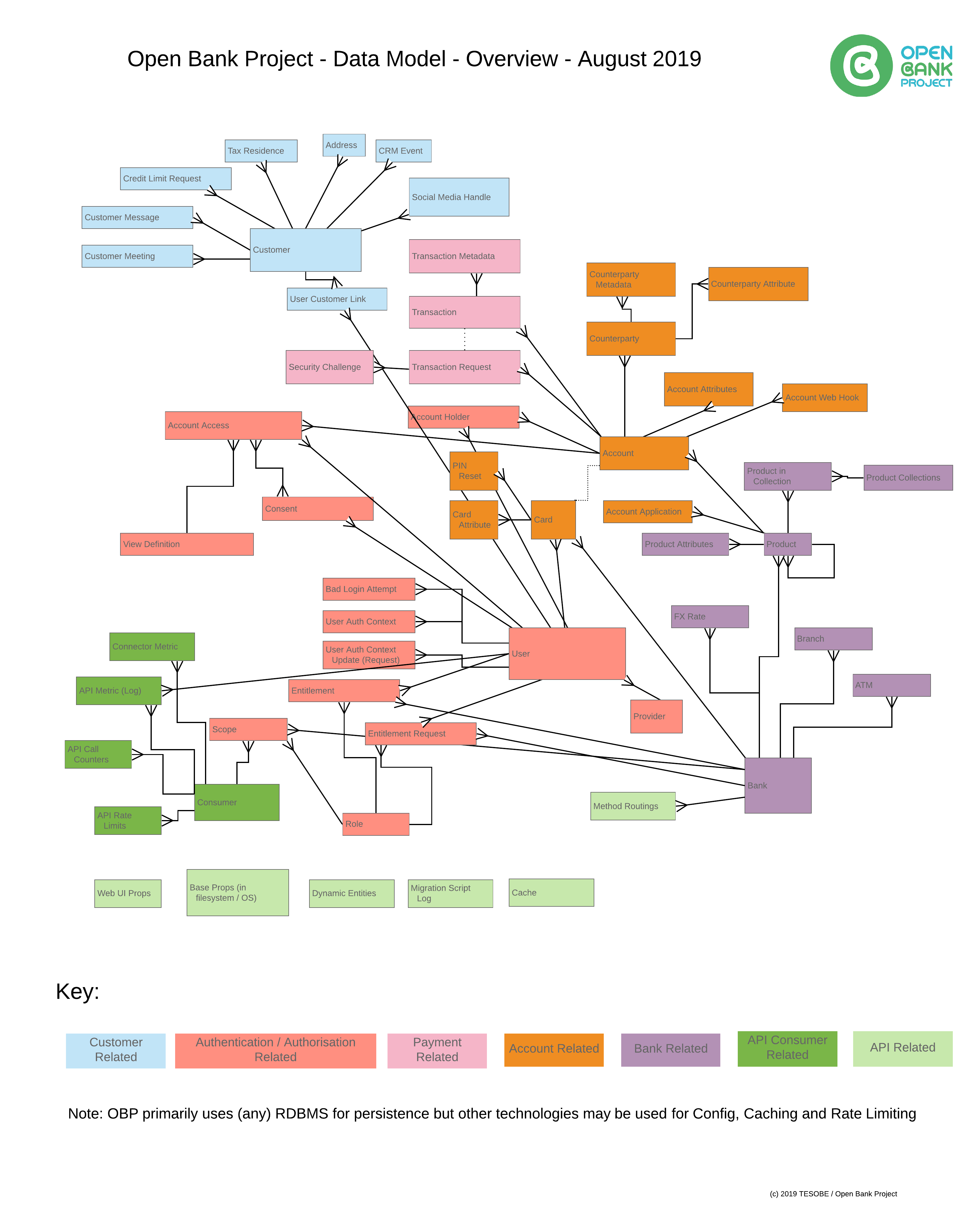

- Data Model Overview

- Direct Login

- Dummy Customer Logins

- Dynamic Endpoint Manage

- Dynamic Message Doc

- Dynamic Resource Doc

- Dynamic linking (PSD2 context)

- Dynamic-Entities

- Dynamic-Entity-Intro

- DynamicConnectorMethod.lang

- DynamicConnectorMethod.methodBody.Java

- DynamicConnectorMethod.methodBody.Js

- DynamicConnectorMethod.methodBody.scala

- DynamicMessageDoc.dynamicMessageDocId

- DynamicMessageDoc.inboundAvroSchema

- DynamicMessageDoc.outboundAvroSchema

- DynamicResourceDoc.description

- DynamicResourceDoc.dynamicResourceDocId

- DynamicResourceDoc.errorResponseBodies

- DynamicResourceDoc.exampleRequestBody

- DynamicResourceDoc.implementedInApiVersion

- DynamicResourceDoc.isFeatured

- DynamicResourceDoc.methodBody

- DynamicResourceDoc.partialFunction

- DynamicResourceDoc.partialFunctionName

- DynamicResourceDoc.partialFunctionName

- DynamicResourceDoc.requestUrl

- DynamicResourceDoc.requestVerb

- DynamicResourceDoc.specialInstructions

- DynamicResourceDoc.specifiedUrl

- DynamicResourceDoc.successResponseBody

- DynamicResourceDoc.summary

- Echo Request Headers

- Endpoint

- Endpoint Mapping

- EndpointTag.endpointTagId

- EndpointTag.tagName

- FAPI

- FAPI 1.0

- FAPI 2.0

- FX-Rates

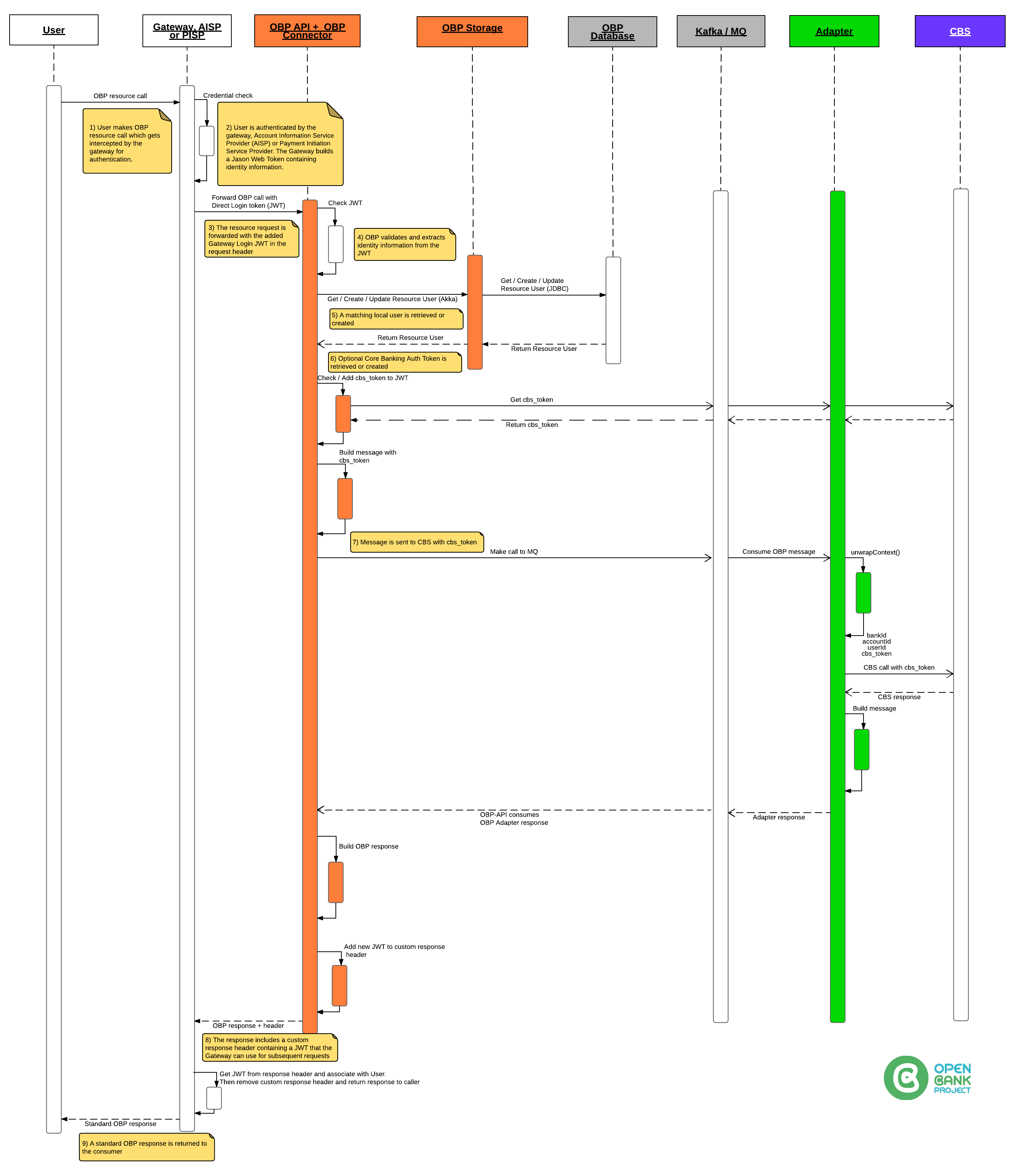

- Gateway Login

- Hola App log trace

- How OpenID Connect Works

- JSON Schema Validation

- Just In Time Entitlements

- KYC (Know Your Customer)

- Keycloak Onboarding

- License.id

- License.name

- Message Doc

- Method Routing

- Multi-factor authentication (MFA)

- My-Dynamic-Entities

- OAuth 1.0a

- OAuth 2

- OAuth 2.0

- OAuth 2.0 Client Credentials Flow Manual

- OCSP

- OIDC

- OpenID Connect with Google

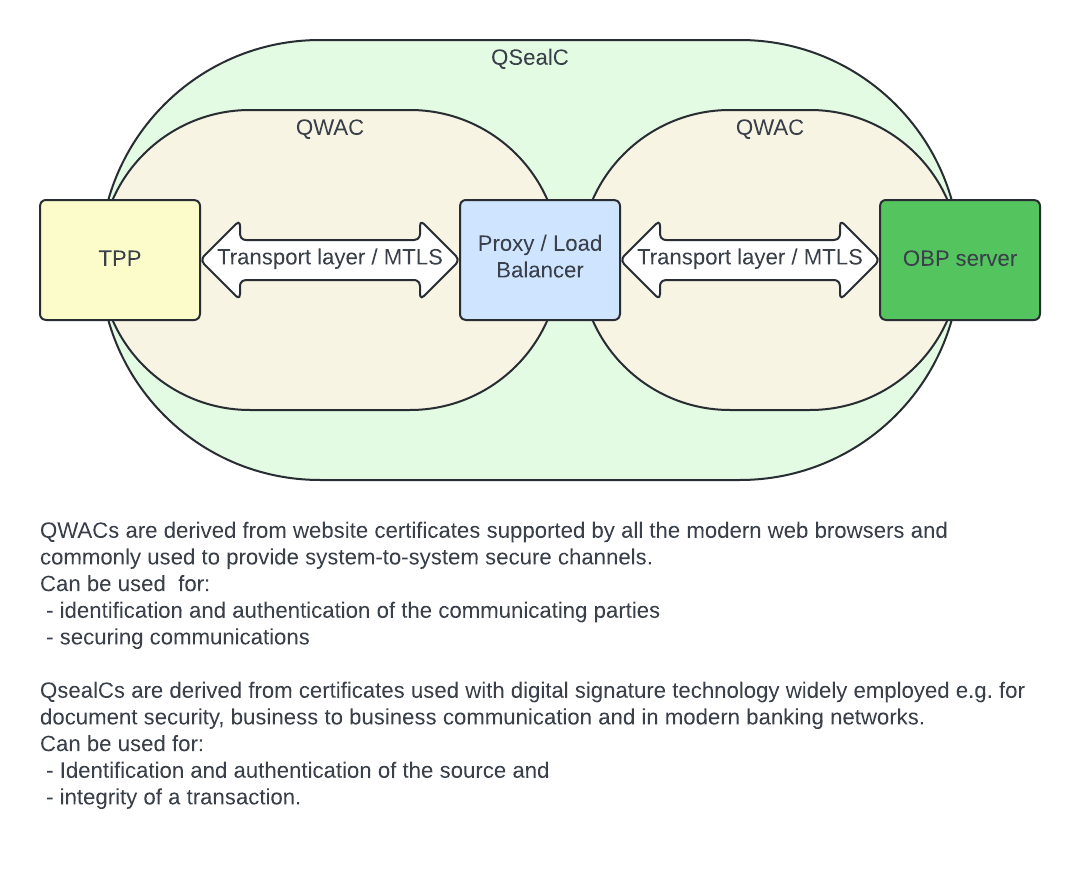

- QSealC

- QWAC

- Qualified Certificate Profiles (PSD2 context)

- Rate Limiting

- Regulated-Entities

- RegulatedEntity.attribute_id

- RegulatedEntity.attribute_name

- RegulatedEntity.attribute_type

- RegulatedEntity.attribute_value

- Risk-based authentication

- Roles of Open Bank Project

- Run via IntelliJ IDEA

- SCA (Strong Customer Authentication)

- Sandbox Introduction

- Scenario 1: Onboarding a User

- Scenario 2: Create a Public Account

- Scenario 3: Create counterparty and make payment

- Scenario 4: Grant account access to another User

- Scenario 5: Onboarding a User using Auth Context

- Scenario 6: Update credit score based on transaction and device data.

- Scenario 7: Onboarding a User with multiple User Auth Context records

- Space

- Static Endpoint

- TPP

- TPP Certificate Verification

- Template.attributeName

- Template.attributeType

- Transaction

- Transaction Requests

- Transaction Requests.Transaction Request Refund Reason Code

- Transaction Requests.Transaction Request Type

- Transaction Requests.attributeId

- Transaction Requests.attributeName

- Transaction Requests.attributeType

- Transaction Requests.attributeValue

- Transaction Requests.id

- Transaction request challenge threshold

- Transaction-Request-Introduction

- Transaction.attributeId

- Transaction.attributeName

- Transaction.attributeType

- Transaction.attributeValue

- Transaction.charge_policy

- Transaction.otherAccountProvider

- Transaction.transactionDescription

- Transaction.transactionId

- Transaction.transactionType

- User

- User Customer Links

- User.attributeName

- User.attributeType

- User.attributeValue

- User.isPersonal

- User.password

- User.provider

- User.provider_id

- User.userId

- User.userNameExample

- User.user_id

- User.username

- accessibility_features

- accessiblefeatures

- account

- account_application_id

- account_applications

- account_attribute_id

- account_attributes

- account_otp

- account_routing

- account_routings

- account_rules

- account_webhook_id

- accounts

- active

- actual_date

- adapter_implementation

- address

- addresses

- age

- akka

- alias

- allowed_actions

- allowed_attempts

- allows

- answer

- api_version

- app_name

- app_type

- atm_id

- atms

- attribute_definition_id

- attribute_id

- attributes

- auth_context_update_id

- available_funds_request_id

- average_response_time

- bad_attempts_since_last_success_or_reset

- balance

- balance_id

- balance_type

- bank

- bank_code

- bank_id_pattern

- bank_routing

- bank_routings

- bankid

- banks

- basket_id

- bespoke

- bic

- branch_number

- branch_routing

- branch_routings

- branch_type

- branches

- cache

- calls_made

- can_add_comment

- can_add_corporate_location

- can_add_counterparty

- can_add_image

- can_add_image_url

- can_add_more_info

- can_add_open_corporates_url

- can_add_physical_location

- can_add_private_alias

- can_add_public_alias

- can_add_tag

- can_add_transaction_request_to_any_account

- can_add_transaction_request_to_own_account

- can_add_url

- can_add_where_tag

- can_be_seen_on_views

- can_create_direct_debit

- can_create_standing_order

- can_delete_comment

- can_delete_corporate_location

- can_delete_image

- can_delete_physical_location

- can_delete_tag

- can_delete_where_tag

- can_edit_owner_comment

- can_query_available_funds

- can_see_bank_account_balance

- can_see_bank_account_bank_name

- can_see_bank_account_credit_limit

- can_see_bank_account_currency

- can_see_bank_account_iban

- can_see_bank_account_label

- can_see_bank_account_national_identifier

- can_see_bank_account_number

- can_see_bank_account_owners

- can_see_bank_account_routing_address

- can_see_bank_account_routing_scheme

- can_see_bank_account_swift_bic

- can_see_bank_account_type

- can_see_bank_routing_address

- can_see_bank_routing_scheme

- can_see_comments

- can_see_corporate_location

- can_see_image_url

- can_see_images

- can_see_more_info

- can_see_open_corporates_url

- can_see_other_account_bank_name

- can_see_other_account_iban

- can_see_other_account_kind

- can_see_other_account_metadata

- can_see_other_account_national_identifier

- can_see_other_account_number

- can_see_other_account_routing_address

- can_see_other_account_routing_scheme

- can_see_other_account_swift_bic

- can_see_other_bank_routing_address

- can_see_other_bank_routing_scheme

- can_see_owner_comment

- can_see_physical_location

- can_see_private_alias

- can_see_public_alias

- can_see_tags

- can_see_transaction_amount

- can_see_transaction_balance

- can_see_transaction_currency

- can_see_transaction_description

- can_see_transaction_finish_date

- can_see_transaction_metadata

- can_see_transaction_other_bank_account

- can_see_transaction_start_date

- can_see_transaction_this_bank_account

- can_see_transaction_type

- can_see_url

- can_see_where_tag

- cancelled

- card_attributes

- card_description

- cards

- category

- certificate_authority_ca_owner_id

- challenge

- challenge_type

- channel

- charge

- checks

- city

- client_id (Client ID)

- closing_time

- code

- collected

- collection_code

- comment_id

- comments

- company

- completed

- connector_name

- connector_version

- consent_id

- consent_id

- consent_request_id

- consents

- consumers

- contact_details

- conversion_value

- corporate_location

- count

- counterparties

- counterparty

- counterparty_limit_id

- country

- country_code

- county

- created

- created_by_user

- created_by_user_id

- creator

- credit_limit

- credit_rating

- creditoraccount

- creditorname

- crm_events

- current_credit_documentation

- current_state

- customer

- customer_address_id

- customer_attributes

- customer_name

- customer_token

- customer_user_id

- customers

- data.bankid

- date_activated

- date_added

- date_inserted

- date_of_application

- debtoraccount

- dependent_endpoints

- description

- detail

- details

- developer_email

- direct_debit_id

- display_name

- distribution_channel

- dob_of_dependants

- document_number

- documents

- domain

- drive_up

- driveup

- duration

- duration_time

- e

- effective_date

- elastic_search

- email_address

- enabled

- end_date

- energy_source

- entitlement_id

- entitlement_request_id

- entitlement_requests

- entitlements

- entity_address

- entity_certificate_public_key

- entity_code

- entity_country

- entity_id

- entity_name

- entity_post_code

- entity_town_city

- entity_type

- entity_web_site

- errorCode

- everything

- example_inbound_message

- example_outbound_message

- execution_date

- execution_time

- face_image

- family

- field

- first_check_number

- first_name

- free_form

- frequency

- friday

- from

- from_currency_code

- from_date

- from_department

- from_person

- full_name

- function_name

- future_date

- generate_accountants_view

- generate_auditors_view

- generate_public_view

- glossary_items

- group

- handle

- hide_metadata_if_alias_used

- holder

- holders

- hosted_at

- hosted_by

- hours

- how

- html

- http_method

- http_protocol

- id

- id

- image_id

- image_url

- images

- implemented_by_partial_function

- implemented_in_version

- inbound_topic

- inboundavroschema

- index

- instructedamount

- inverse_conversion_value

- invitees

- is_active

- is_alias

- is_bank_id_exact_match

- is_firehose

- is_public

- issue_place

- items

- jsonstring

- jwks_uri

- jwks_uris

- jwt

- keys

- kid

- kind

- kty

- kyc_check_id

- kyc_document

- kyc_document_id

- kyc_media_id

- last_failure_date

- last_lock_date

- last_name

- last_ok_date

- latitude

- license

- line1

- line2

- line3

- link

- list

- lobby

- location

- log_level

- logo

- logo_url

- longitude

- markdown

- match_all

- max_monthly_amount

- max_number_of_monthly_transactions

- max_number_of_transactions

- max_number_of_yearly_transactions

- max_single_amount

- max_total_amount

- max_yearly_amount

- maximum_response_time

- medias

- meeting_id

- meetings

- member_product_code

- message

- message_docs

- message_format

- messages

- meta

- metadata

- metadata_view

- method_name

- method_routing_id

- method_routings

- metrics

- minimum_response_time

- mobile_phone

- mobile_phone_number

- monday

- more_info

- more_info_url

- n

- name

- narrative

- national_identifier

- networks

- new_balance

- nickname

- nominal_interest1

- nominal_interest2

- none

- number

- number_of_checkbooks

- ok

- on_hot_list

- open_corporates_url

- opening_time

- order

- order_date

- order_id

- orders

- organisation

- organisation_website

- other_account

- other_account_id

- other_account_routing_address

- other_account_routing_scheme

- other_account_secondary_routing_address

- other_account_secondary_routing_scheme

- other_accounts

- other_bank_routing_address

- other_bank_routing_scheme

- other_branch_routing_address

- other_branch_routing_scheme

- outbound_topic

- outboundavroschema

- overall_balance

- overall_balance_date

- owners

- parameters

- parent_product

- parent_product_code

- payload

- paymentService

- per_day

- per_day_call_limit

- per_hour

- per_hour_call_limit

- per_minute

- per_minute_call_limit

- per_month

- per_month_call_limit

- per_second

- per_second_call_limit

- per_week

- per_week_call_limit

- permissions

- phone

- phone_number

- physical_location

- pin_reset

- ports

- post_code

- postcode

- posted

- present

- private_alias

- process

- product_attribute_id

- product_attributes

- product_code

- product_collection

- product_fee_id

- product_name

- products

- property

- provider

- provider_id

- public_alias

- purpose

- purpose_id

- query

- rank_amount1

- rank_amount2

- reason_requested

- reasons

- redirect_url

- relates_to_kyc_check_id

- relates_to_kyc_document_id

- replacement

- request_id

- requested_current_rate_amount1

- requested_current_rate_amount2

- requested_current_valid_end_date

- requested_temporary_valid_end_date

- require_scopes_for_all_roles

- require_scopes_for_listed_roles

- requiredfieldinfo

- requires_bank_id

- reset_in_seconds

- reset_password_url

- result

- revoked

- role

- role_name

- roles

- sandbox_tan

- satisfied

- saturday

- sca_method

- scheduled_date

- scheme

- scope_id

- scopes

- sepa

- sepaB2b

- sepaCardClearing

- sepaCreditTransfer

- sepaDirectDebit

- sepaSddCore

- service_available

- services

- settlement_accounts

- shipping_code

- short_code

- short_name

- short_reference

- shortcode

- sms

- staff_name

- staff_token

- staff_user_id

- standing_order_id

- state

- status

- status

- statuses

- success

- suggested_order

- summary

- sunday

- super_family

- supported_currencies

- supported_languages

- swift_bic

- tag_id

- tags

- tax_number

- tax_residence

- tax_residence_id

- technology

- temporary_credit_documentation

- temporary_requested_current_amount

- terms_and_conditions_url_example

- text

- this_account

- this_account_id

- this_bank_id

- this_view_id

- thursday

- time_to_live

- to

- to_counterparty

- to_currency_code

- to_date

- to_sandbox_tan

- to_sepa

- to_sepa_credit_transfers

- to_transfer_to_account

- to_transfer_to_atm

- to_transfer_to_phone

- token

- top_apis

- top_consumers

- transaction_attributes

- transaction_ids

- transaction_request_types

- transaction_requests_with_charges

- transaction_types

- transactions

- transfer_type

- transport

- trigger_name

- ttl_in_seconds

- tuesday

- type

- type_of_lock

- use

- use_type

- user

- user_auth_context_id

- user_auth_context_update_id

- user_auth_contexts

- user_customer_link_id

- user_customer_links

- users

- valid_from

- verb

- version

- version_status

- view

- view.description

- view.id

- view.is_system

- view.name

- views

- views_available

- views_basic

- vrp_consent_request.payload

- warehouse

- web_hooks

- web_ui_props_id

- website

- webui_props

- wednesday

- when

- where

- which_alias_to_use

API Glossary

ABAC_Object_Properties_Reference

ABAC Object Properties Reference

This document lists all properties available on objects passed to ABAC rules.

User Object

Available as: authenticatedUser, user, onBehalfOfUserOpt.get

Core Properties

user.userId // String - Unique user ID

user.emailAddress // String - User's email

user.name // String - Display name

user.provider // String - Auth provider

user.providerId // String - Provider's user ID

Usage Examples

// Check if user is admin

user.emailAddress.endsWith("@admin.com")

// Check specific user

user.userId == "alice@example.com"

BankAccount Object

Available as: accountOpt.get

Core Properties

account.accountId // AccountId - Account identifier

account.bankId // BankId - Bank identifier

account.accountType // String - Account type

account.balance // BigDecimal - Current balance

account.currency // String - Currency code (e.g., "EUR")

account.name // String - Account name

account.label // String - Account label

account.owners // List[User] - Account owners

Usage Examples

// Check balance

accountOpt.exists(_.balance.toDouble >= 1000.0)

// Check ownership

accountOpt.exists(account =>

account.owners.exists(owner => owner.userId == user.userId)

)

// Check currency

accountOpt.exists(_.currency == "EUR")

Bank Object

Available as: bankOpt.get

Core Properties

bank.bankId // BankId - Bank identifier

bank.shortName // String - Short name

bank.fullName // String - Full legal name

bank.logoUrl // String - URL to bank logo

bank.websiteUrl // String - Bank website URL

bank.bankRoutingScheme // String - Routing scheme

bank.bankRoutingAddress // String - Routing address

Usage Examples

// Check specific bank

bankOpt.exists(_.bankId.value == "gh.29.uk")

// Check bank by routing

bankOpt.exists(_.bankRoutingScheme == "SWIFT_BIC")

Transaction Object

Available as: transactionOpt.get

Core Properties

transaction.id // TransactionId - Transaction ID

transaction.amount // BigDecimal - Transaction amount

transaction.currency // String - Currency code

transaction.description // String - Description

transaction.startDate // Option[Date] - Posted date

transaction.finishDate // Option[Date] - Completed date

transaction.transactionType // String - Transaction type

Usage Examples

// Check transaction amount

transactionOpt.exists(tx => tx.amount.abs.toDouble < 100.0)

// Check transaction type

transactionOpt.exists(_.transactionType == "SEPA")

Customer Object

Available as: customerOpt.get

Core Properties

customer.customerId // String - Customer ID

customer.customerNumber // String - Customer number

customer.legalName // String - Legal name

customer.mobileNumber // String - Mobile number

customer.email // String - Email address

customer.dateOfBirth // Date - Date of birth

Usage Examples

// Check customer email domain

customerOpt.exists(_.email.endsWith("@company.com"))

Attribute Objects

UserAttributeTrait

attr.name // String - Attribute name

attr.value // String - Attribute value

attr.attributeType // UserAttributeType - Type of attribute

Usage Example

// Check for specific non-personal attribute

authenticatedUserAttributes.exists(attr =>

attr.name == "department" && attr.value == "finance"

)

// Note: User attributes in ABAC rules only include non-personal attributes

// (where IsPersonal=false). Personal attributes are not available for

// privacy and GDPR compliance reasons.

Related Documentation:

- ABAC_Simple_Guide - Getting started guide

- ABAC_Parameters_Summary - Complete parameter list

ABAC_Parameters_Summary

ABAC Rule Parameters Summary

The ABAC Rules Engine provides 18 parameters to your rule function, organized into three categories:

User Parameters (6 parameters)

- authenticatedUser: User - The logged-in user

- authenticatedUserAttributes: List[UserAttributeTrait] - Non-personal attributes of authenticated user (IsPersonal=false)

- authenticatedUserAuthContext: List[UserAuthContext] - Auth context of authenticated user

- onBehalfOfUserOpt: Option[User] - User being acted on behalf of (if provided)

- onBehalfOfUserAttributes: List[UserAttributeTrait] - Non-personal attributes of on-behalf-of user (IsPersonal=false)

- onBehalfOfUserAuthContext: List[UserAuthContext] - Auth context of on-behalf-of user

Target User Parameters (3 parameters)

- userOpt: Option[User] - Target user being evaluated

- userAttributes: List[UserAttributeTrait] - Non-personal attributes of target user (IsPersonal=false)

- user: User - Resolved target user (defaults to authenticatedUser)

Resource Context Parameters (9 parameters)

- bankOpt: Option[Bank] - Bank context (if bank_id provided)

- bankAttributes: List[BankAttributeTrait] - Bank attributes

- accountOpt: Option[BankAccount] - Account context (if account_id provided)

- accountAttributes: List[AccountAttribute] - Account attributes

- transactionOpt: Option[Transaction] - Transaction context (if transaction_id provided)

- transactionAttributes: List[TransactionAttribute] - Transaction attributes

- transactionRequestOpt: Option[TransactionRequest] - Transaction request context

- transactionRequestAttributes: List[TransactionRequestAttributeTrait] - Transaction request attributes

- customerOpt: Option[Customer] - Customer context (if customer_id provided)

- customerAttributes: List[CustomerAttribute] - Customer attributes

Usage in Rules

// Access user email

authenticatedUser.emailAddress

// Check if account exists and has sufficient balance

accountOpt.exists(account => account.balance.toDouble >= 1000.0)

// Check user attributes (non-personal only)

authenticatedUserAttributes.exists(attr =>

attr.name == "role" && attr.value == "admin"

)

// Note: Only non-personal attributes (IsPersonal=false) are included

// Check delegation

onBehalfOfUserOpt.isDefined

Related Documentation:

- ABAC_Simple_Guide - Getting started guide

- ABAC_Object_Properties_Reference - Detailed property reference

ABAC_Simple_Guide

ABAC Rules Engine - Simple Guide

Overview

The ABAC (Attribute-Based Access Control) Rules Engine allows you to create dynamic access control rules in Scala that evaluate whether a user should have access to a resource.

API Usage

Endpoint

POST https://apisandbox.openbankproject.com/obp/v6.0.0/management/abac-rules/{RULE_ID}/execute

Request Example

curl -X POST \

'https://apisandbox.openbankproject.com/obp/v6.0.0/management/abac-rules/admin-only-rule/execute' \

-H 'Authorization: DirectLogin token=eyJhbGciOiJIUzI1...' \

-H 'Content-Type: application/json' \

-d '{

"bank_id": "gh.29.uk",

"account_id": "8ca8a7e4-6d02-48e3-a029-0b2bf89de9f0"

}'

Understanding the Three User Parameters

1. authenticatedUserId (Required)

The person actually logged in and making the API call

- The real user who authenticated

- Retrieved from the authentication token

2. onBehalfOfUserId (Optional)

When someone acts on behalf of another user (delegation)

- Used for delegation scenarios

- The authenticated user is acting for someone else

- Common in customer service, admin tools, power of attorney

3. userId (Optional)

The target user being evaluated by the rule

- Defaults to

authenticatedUserIdif not provided - The user whose permissions/attributes are being checked

- Useful for testing rules for different users

Writing ABAC Rules

Simple Rule Examples

Rule 1: User Must Own Account

accountOpt.exists(account =>

account.owners.exists(owner => owner.userId == user.userId)

)

Rule 2: Admin or Owner

val isAdmin = authenticatedUser.emailAddress.endsWith("@admin.com")

val isOwner = accountOpt.exists(account =>

account.owners.exists(owner => owner.userId == user.userId)

)

isAdmin || isOwner

Rule 3: Account Balance Check

accountOpt.exists(account => account.balance.toDouble >= 1000.0)

Available Objects in Rules

authenticatedUser: User // The logged in user

onBehalfOfUserOpt: Option[User] // User being acted on behalf of (if provided)

user: User // The target user being evaluated

bankOpt: Option[Bank] // Bank context (if bank_id provided)

accountOpt: Option[BankAccount] // Account context (if account_id provided)

transactionOpt: Option[Transaction] // Transaction context (if transaction_id provided)

customerOpt: Option[Customer] // Customer context (if customer_id provided)

Related Documentation:

- ABAC_Parameters_Summary - Complete list of all 18 parameters

- ABAC_Object_Properties_Reference - Detailed property reference

- ABAC_Testing_Examples - More testing examples

ABAC_Testing_Examples

ABAC Testing Examples

API Endpoint

POST https://apisandbox.openbankproject.com/obp/v6.0.0/management/abac-rules/{RULE_ID}/execute

Example 1: Admin Only Rule

Rule Code:

authenticatedUser.emailAddress.endsWith("@admin.com")

Test Request:

curl -X POST \

'https://apisandbox.openbankproject.com/obp/v6.0.0/management/abac-rules/admin-only-rule/execute' \

-H 'Authorization: DirectLogin token=YOUR_TOKEN' \

-H 'Content-Type: application/json' \

-d '{}'

Expected Result:

- Admin user → {"result": true}

- Regular user → {"result": false}

Example 2: Account Owner Check

Rule Code:

accountOpt.exists(account =>

account.owners.exists(owner => owner.userId == user.userId)

)

Test Request:

curl -X POST \

'https://apisandbox.openbankproject.com/obp/v6.0.0/management/abac-rules/account-owner-only/execute' \

-H 'Authorization: DirectLogin token=YOUR_TOKEN' \

-H 'Content-Type: application/json' \

-d '{

"user_id": "alice@example.com",

"bank_id": "gh.29.uk",

"account_id": "8ca8a7e4-6d02-48e3-a029-0b2bf89de9f0"

}'

Example 3: Balance Check

Rule Code:

accountOpt.exists(account => account.balance.toDouble >= 1000.0)

Test Request:

curl -X POST \

'https://apisandbox.openbankproject.com/obp/v6.0.0/management/abac-rules/high-balance-only/execute' \

-H 'Authorization: DirectLogin token=YOUR_TOKEN' \

-H 'Content-Type: application/json' \

-d '{

"bank_id": "gh.29.uk",

"account_id": "8ca8a7e4-6d02-48e3-a029-0b2bf89de9f0"

}'

Example 4: Transaction Amount Check

Rule Code:

transactionOpt.exists(tx => tx.amount.abs.toDouble < 100.0)

Test Request:

curl -X POST \

'https://apisandbox.openbankproject.com/obp/v6.0.0/management/abac-rules/small-transactions/execute' \

-H 'Authorization: DirectLogin token=YOUR_TOKEN' \

-H 'Content-Type: application/json' \

-d '{

"bank_id": "gh.29.uk",

"account_id": "8ca8a7e4-6d02-48e3-a029-0b2bf89de9f0",

"transaction_id": "trans-123"

}'

Testing Patterns

Pattern 1: Test Different Users

# Test for admin

curl -X POST 'https://apisandbox.openbankproject.com/obp/v6.0.0/management/abac-rules/RULE_ID/execute' \

-d '{"user_id": "admin@admin.com", "bank_id": "gh.29.uk"}'

# Test for regular user

curl -X POST 'https://apisandbox.openbankproject.com/obp/v6.0.0/management/abac-rules/RULE_ID/execute' \

-d '{"user_id": "alice@example.com", "bank_id": "gh.29.uk"}'

Pattern 2: Test Edge Cases

# No context (minimal)

curl -X POST 'https://apisandbox.openbankproject.com/obp/v6.0.0/management/abac-rules/RULE_ID/execute' -d '{}'

# Full context

curl -X POST 'https://apisandbox.openbankproject.com/obp/v6.0.0/management/abac-rules/RULE_ID/execute' -d '{

"user_id": "alice@example.com",

"bank_id": "gh.29.uk",

"account_id": "8ca8a7e4-6d02-48e3-a029-0b2bf89de9f0",

"transaction_id": "trans-123",

"customer_id": "cust-456"

}'

Common Errors

Error 1: Rule Not Found

curl -X POST 'https://apisandbox.openbankproject.com/obp/v6.0.0/management/abac-rules/nonexistent-rule/execute' \

-H 'Authorization: DirectLogin token=YOUR_TOKEN' \

-d '{}'

Response: {"error": "ABAC Rule not found with ID: nonexistent-rule"}

Error 2: Invalid Context

Response: Objects will be None if IDs are invalid, rule should handle gracefully

Related Documentation:

- ABAC_Simple_Guide - Getting started guide

- ABAC_Parameters_Summary - Complete parameter list

- ABAC_Object_Properties_Reference - Property reference

API

The terms API (Application Programming Interface) and Endpoint are used somewhat interchangeably.

However, an API normally refers to a group of Endpoints.

An endpoint has a unique URL path and HTTP verb (GET, POST, PUT, DELETE etc).

When we POST a Swagger file to the Create Endpoint endpoint, we are in fact creating a set of Endpoints that have a common Tag. Tags are used to group Endpoints in the API Explorer and filter the Endpoints in the Resource Doc endpoints.

Endpoints can also be grouped together in Collections.

See also Endpoint

API Collection

An API Collection is a collection of endpoints grouped together for a certain purpose.

Having read access to a Collection does not constitute execute access on the endpoints in the Collection.

(Execute access is governed by Entitlements to Roles - and in some cases, Views.)

Collections can be created and shared. You can make a collection non-sharable but the default is sharable.

Your "Favourites" in API Explorer is actually a collection you control named "Favourites".

To share a Collection (e.g. your Favourites) just click on your Favourites in the API Explorer and share the URL in the browser. If you want to share the Collection via an API, just share the collection_id with a developer.

If you share a Collection it can't be modified by anyone else, but anyone can use it as a basis for their own Favourites or another collection.

There are over 13 endpoints for controlling Collections.

Some of these endpoints require Entitlements to Roles and some operate on your own personal collections such as your favourites.

API-Explorer-II-Help

API Explorer II - How to Use

API Explorer II is an interactive Swagger/OpenAPI interface for discovering and testing OBP and other standard endpoints.

Key Features

- Browse and search all available API endpoints

- Execute API calls directly from your browser

- View request and response examples

- Test authentication and authorization flows

Finding Dynamic Entities

Dynamic Entities can be found under the More list of API Versions. Look for versions starting with OBPdynamic-entity or similar in the version selector.

For more information about Dynamic Entities see here

Creating Favorites

If you click the star icon next to an endpoint, it will be added to your favorites list.

Favorites appear in the Collections section in the left panel interface.

Note: Favorites are a special type of collection. You can create other collections using endpoints.

API.Access Control

Access Control is achieved via the following mechanisms in OBP:

-

APIs are enabled in Props. See the README.md

-

Consumers (AKA Clients or Apps) are granted access to Roles and Views via Scopes

See here for related endpoints and documentation.

- Users are granted access to System or Bank Roles via Entitlements.

See here for related endpoints and documentation.

Users may request Entitlement Requests here

Entitlements and Entitlement Requests can be managed in the OBP API Manager.

- Users are granted access to Customer Accounts, Transactions and Payments via Views.

See here for related endpoints and documentation.

User Views can be managed via the OBP Sofit Consent App.

API.correlation_id

Example value: 1flssoftxq0cr1nssr68u0mioj

Description: A string generated by OBP-API that MUST uniquely identify the API call received by OBP-API. Used for debugging and logging purposes. It is returned in header to the caller.

ATM.attribute_id

Example value: atme-9a0f-4bfa-b30b-9003aa467f51

Description: A string that MUST uniquely identify the ATM on this OBP instance.

Account

The thing that tokens of value (money) come in and out of.

An account has one or more owners which are Users.

In the future, Customers may also be owners.

An account has a balance in a specified currency and zero or more transactions which are records of successful movements of money.

Account Access

Account Access governs access to Bank Accounts by end Users. It is an intersecting entity between the User and the View Definition.

A User must have at least one Account Access record record in order to interact with a Bank Account over the OBP API.

Account.account_id

An identifier for the account that MUST NOT leak the account number or other identifier nomrally used by the customer or bank staff.

It SHOULD be a UUID. It MUST be unique in combination with the BANK_ID. ACCOUNT_ID is used in many URLS so it should be considered public.

(We do NOT use account number in URLs since URLs are cached and logged all over the internet.)

In local / sandbox mode, ACCOUNT_ID is generated as a UUID and stored in the database.

In non sandbox modes (RabbitMq etc.), ACCOUNT_ID is mapped to core banking account numbers / identifiers at the South Side Adapter level.

ACCOUNT_ID is used to link Metadata and Views so it must be persistant and known to the North Side (OBP-API).

Example value: 8ca8a7e4-6d02-40e3-a129-0b2bf89de9f0

Account.account_routing_address

Example value: DE91 1000 0000 0123 4567 89

Description: An identifier that conforms to account_routing_scheme / accountRoutingScheme

Account.account_routing_scheme

Example value: IBAN

Description: The scheme that the account_routing_address / accountRoutingAddress is an example of.

Account.iban

Example value: DE91 1000 0000 0123 4567 89

Description: MUST uniquely identify the bank account globally.

Account.queryTagsExample

Example value: Card,Debit

Description: This field is only used for OBP to distinguish the debit accounts, card accounts ...

Adapter.Akka.Intro

Use Akka as an interface between OBP and your Core Banking System (CBS).

For an introduction to Akka see here

The OBP Akka interface allows integrators to write Java or Scala Adapters (any JVM language with Akka support)

respond to requests for data and services from OBP.

For the message definitions see here

Installation Prerequisites

-

You have OBP-API running.

-

Ideally you have API Explorer running (the application serving this page) but its not necessary - you could use any other REST client.

- You might want to also run API Manager as it makes it easier to grant yourself roles, but its not necessary - you could use the API Explorer / any REST client instead.

Create a Customer User and an Admin User

- Register a User who will use the API as a Customer.

- Register another User that will use the API as an Admin. The Admin user will need some Roles. See here. You can bootstrap an Admin user by editing the Props file. See the README for that.

Add some authentication context to the Customer User

- As the Admin User, use the Create Auth Context endpoint to add one or more attributes to the Customer User.

For instance you could add the name/value pair CUSTOMER_NUMBER/889763 and this will be sent to the Adapter / CBS inside the AuthInfo object.

Now you should be able to use the Get Auth Contexts endpoint to see the data you added.

Write or Build an Adapter to respond to the following messages.

When getting started, we suggest that you implement the messages in the following order:

1) Core (Prerequisites) - Get Adapter, Get Banks, Get Bank

Now you should be able to use the Adapter Info endpoint

Now you should be able to use the Get Banks endpoint

Now you should be able to use the Get Bank endpoint

2) Get Customers by USER_ID

Now you should be able to use the Get Customers endpoint.

3) Get Accounts

The above messages should enable at least the following endpoints:

4) Get Account

The above message should enable at least the following endpoints:

5) Get Transactions

6) Manage Counterparties

7) Get Transaction Request Types

- This is configured using OBP Props - No messages required

This glossary item is Work In Progress.

Adapter.Stored_Procedure.Intro

Use Stored_Procedure as an interface between OBP and your Core Banking System (CBS).

For an introduction to Stored Procedures see here

Installation Prerequisites

- You have OBP-API running and it is connected to a stored procedure related database.

- Ideally you have API Explorer running (the application serving this page) but its not necessary - you could use any other REST client.

- You might want to also run API Manager as it makes it easier to grant yourself roles, but its not necessary - you could use the API Explorer / any REST client instead.

Adapter.authInfo

authInfo is a JSON object sent by the Connector to the Adapter so the Adapter and/or Core Banking System can

identify the User making the call.

The authInfo object contains several optional objects and fields.

Please see the Message Docs for your connector for the current JSON structure. The following serves as a guide:

- userId is the user_id as generated by OBP

- username can be chosen explicitly to match an existing customer number (not recommended)

- linkedCustomers is a list of Customers the User is explicitly linked to. Use the Create User Customer Link endpoint to populate this data.

- userAuthContexts may contain the customer number or other tokens in order to boot strap the User Customer Links

or provide an alternative method of tagging the User with an authorisation context.

Use the Create UserAuthContext endpoint to populate this data. - cbsToken is a token used by the CBS to identify the user's session. Either generated by the CBS or Gateway.

- isFirst is a flag that indicates that OBP should refresh the user's list of accounts from the CBS (and flush / invalidate any User's cache)

- correlationId just identifies the API call.

- authViews are entitlements given by account holders to third party users e.g. Sam may grant her accountant Jill read only access to her business account. See the Create View endpoint

Adapter.card_attribute_id

Example value: b4e0352a-9a0f-4bfa-b30b-9003aa467f50

Description: A string that MUST uniquely identify the card attribute on this OBP instance. It SHOULD be a UUID.

Adapter.card_attribute_name

Example value: OVERDRAFT_START_DATE

Description: The Card attribute name

Adapter.card_id

Example value: 36f8a9e6-c2b1-407a-8bd0-421b7119307e

Description: A string that MUST uniquely identify the card on this OBP instance. It SHOULD be a UUID.

Adapter.card_type

Example value: Credit

Description: The type of the physical card. eg: credit, debit ...

Adapter.cbsToken

Example value: FYIUYF6SUYFSD

Description: A token provided by the Gateway for use by the Core Banking System

Adapter.issue_number

Example value: 1

Description: The issue number of the physical card, eg 1,2,3,4 ....

Adapter.key

Example value: CustomerNumber

Description: This key should be used with Adapter.value together. They are a pair.

Adapter.provider_id

Example value: Chris

Description: The provider id of the user which is equivalent to the username. Used in combination with the provider name (host) to uniquely identify a User on OBP.

Adapter.serial_number

Example value: 1324234

Description: The serial number of the physical card, eg 1123.

Adapter.value

Example value: 5987953

Description: This key should be used with Adapter.key together. They are a pair.

Adaptive authentication

Adaptive authentication, also known as risk-based authentication, is dynamic in a way it automatically triggers additional authentication factors, usually via MFA factors, depending on a user's risk profile.

An example of this authentication at OBP-API side is the feature "Transaction request challenge threshold".

-

Agent.agent_id

Example value: 7uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: A non human friendly string that identifies the agent and is used in URLs. This SHOULD NOT be the agent number. The combination of agentId and bankId MUST be unique on an OBP instance. AgentId SHOULD be unique on an OBP instance. Ideally agentId is a UUID. A mapping between agent number and agent id is kept in OBP.

Agent.agent_number

Example value: 5987953

Description: The human friendly agent identifier that MUST uniquely identify the Agent at the Bank ID. Agent Number is NOT used in URLs.

ApiCollection.apiCollectionId

Example value: 7uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: A string that MUST uniquely identify the session on this OBP instance, can be used in all cache.

ApiCollectionEndpoint.apiCollectionEndpointId

Example value: 8uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: A string that MUST uniquely identify the session on this OBP instance, can be used in all cache.

ApiCollectionEndpoint.operationId

Example value: OBPv4.0.0-getBanks

Description: A uniquely identify the obp endpoint on OBP instance, you can get it from Get Resource endpoints.

Authentication

Authentication generally refers to a set of processes which result in a resource server (in this case, OBP-API) knowing about the User and/or Application that is making the http request it receives.

In most cases when we talk about authentication we are thinking about User authentication, e.g. the user J.Brown is requesting data from the API.

However, user authentication is pretty much always accompanied by knowledge of the Client AKA Consumer, TPP or Application.

In some cases, we only perform Client authentication which results in knowledge of the Application but not the human that is making the call. This is useful when we want to protect the identity of a user but still want to control access to the API.

In most cases, OBP-API server knows about at least two entities involved in the http request / call: The Client and the User - but it will also know about (and trust) the Identity Server (Provider) that authenticated the user and other elements in the chain of trust such as load balancers and certificate authorities.

In simple terms, there are two phases of the Authentication process:

1) The phase where an authorisation token is obtained.

2) The phase where an authorisation token is used.

Phase 1 is an exchange of credentials such as a username and password and possibly knowledge of a "second factor" for a token.

Phase 2 is the execution of an http call which contains the token in a "header" in exchange for some response data or some resource being created, update or deleted.

There are several methods of obtaining and using a token which vary in their ease of use and security.

Direct Login and OAuth 1.0a are used for testing purposes / local installations and are built into OBP.

OAuth2 / Open ID Connect (OIDC) depend on the configuration of Identity Provider solutions such as Keycloak or Hydra or external services such as Google or Yahoo.

Open Bank Project can support multiple identity providers per OBP instance. For example, for a single OBP installation, some Users could authenticate against Google and some could authenticate against a local identity provider.

In the cases where multiple identity providers are configured, OBP differentiates between Users by not only their Username but also by their "Identity Provider". i.e. J.Brown logged in via Google is distinct from J.Brown who logged in via a local OBP instance.

Phase 1 generally results in a temporary token i.e. a token that is valid for a limited amount of time e.g. 2 hours or 3 minutes.

Phase 1 might also result in a token that represents a subset of the User's full permissions. This token is generally called a Consent. i.e. a User might give consent for an application to access one of her accounts but not all of them. A Consent is generally given to a Client and bound to that Client i.e. no other application may use it.

Phase 2 results in OBP having identified a User record in the OBP database so that Authorisation can proceed.

Authentication Device (AD)

The device on which the user will authenticate and authorize the request, often a smartphone.

Authentication.provider

Example value: http://127.0.0.1:8080

Description: The host name of an Identity Provider authenticating a User. OBP allows the use of multiple simultanious authentication providers. The provider name (host) along with the provider id (a username or id) uniquely identifies a user on OBP.

Authorization

If Authentication involves the process of determining the identity of a user or application, Authorization involves the process of determining what the user or application can do.

In OBP, Endpoints are protected by "Guards".

There are two types of permissions which can be granted:

1) Entitlements to Roles provide course grained access to resources which are related to the OBP system or a bank / space e.g. CanCreateAtm would allow the holder to create an ATM record.

2) Account Access records provide fine grained permissions to customer bank accounts, their transactions and payments through Views. e.g. the A User with the Balances View on Account No 12345 would be allowed to get the balances on that account.

Both types of permissions can be encapsulated in Consents or other authentication mechanisms.

When OBP receives a call, after authentication is performed, OBP checks if the caller has sufficient permissions.

If an endpoint guard blocks a call due to insufficient permissions / authorization, OBP will return an OBP- error message.

If the caller passes the guards, the OBP-API forwards the request to the next step in the process.

Note: All OBP- error messages can be found in the OBP-API logs and OBP source code for debugging purposes.

Available FAPI profiles

The following are the FAPI profiles which are either in use by multiple implementers or which are being actively developed by the OpenID Foundation’s FAPI working group:

Bank

A Bank (aka Space) represents a financial institution, brand or organizational unit under which resources such as endpoints and entities exist.

Both standard entities (e.g. financial products and bank accounts in the OBP standard) and dynamic entities and endpoints (created by you or your organisation) can exist at the Bank level.

For example see Bank/Space level Dynamic Entities and Bank/Space level Dynamic Endpoints

The Bank is important because many Roles can be granted at the Bank level. In this way, it's possible to create segregated or partitioned sets of endpoints and data structures in a single OBP instance.

A User creating a Bank (if they have the right so to do), automatically gets the Entitlement to grant any Role for that Bank. Thus the creator of a Bank / Space becomes the "god" of that Bank / Space.

Basic attributes for the bank resource include identifying information such as name, logo and website.

Using the OBP endpoints for bank accounts it's possible to view accounts at one Bank or aggregate accounts from all Banks connected to the OBP instance.

See also Props settings named "brand".

Bank.bank_id

An identifier that uniquely identifies the bank or financial institution on the OBP-API instance.

It is typically a human (developer) friendly string for ease of identification.

It SHOULD NOT contain spaces.

In sandbox mode it typically has the form: "financialinstitutuion.sequencennumber.region.language". e.g. "bnpp-irb.01.it.it"

For production, it's value could be the BIC of the institution.

Example value: gh.29.uk

Bank.bank_id

Example value: gh.29.uk

Description: A string that MUST uniquely identify the bank on this OBP instance. It COULD be a UUID but is generally a short string that easily identifies the bank / brand it represents.

Bank.bank_routing_address

Example value: GENODEM1GLS

Description: An identifier that conforms to bank_routing_scheme / bankRoutingScheme

Bank.bank_routing_scheme

Example value: BIC

Description: The scheme that the bank_routing_address / bankRoutingAddress is an example of.

Branch

The bank branches, it contains the address, location, lobby, drive_up of the Branch.

Branch.branch_id

Example value: DERBY6

Description: Uniquely identifies the Branch in combination with the bankId.

Branch.branch_routing_address

Example value: DERBY6

Description: An address that conforms to branch_routing_scheme / branchRoutingScheme

Branch.branch_routing_scheme

Example value: BRANCH-CODE

Description: The scheme that the branch_routing_address / branchRoutingAddress is an example of.

CIBA

An acronym for Client-Initiated Backchannel Authentication.

For more details about it please take a look at the official specification: OpenID Connect Client Initiated Backchannel Authentication Flow

Please note it is a cross-device protocol and SHOULD not be used for same-device scenarios.

If the Consumption Device and Authorization Device are the same device, protocols like OpenID Connect Core OpenID.Core and OAuth 2.0 Authorization Code Grant as defined in RFC6749 are more appropriate.

CRL

Certificate Revocation List.

CRL issuers issue CRLs. The CRL issuer is either the CA (certification authority) or an entity that has been authorized by the CA to issue CRLs.

CAs publish CRLs to provide status information about the certificates they issued.

However, a CA may delegate this responsibility to another trusted authority.

It is described in RFC 5280.

ChallengeAnswer.challengeId

Example value: 123chaneid13-6d02-40e3-a129-0b2bf89de9f0

Description: MUST uniquely identify the challenge globally.

ChallengeAnswer.hashOfSuppliedAnswer

Example value: a665a45920422f9d417e4867efdc4fb8a04a1f3fff1fa07e998e86f7f7a27ae3

Description: Sha256 hash value of the ChallengeAnswer.challengeId

ChallengeAnswer.suppliedAnswerExample

Example value: 123456

Description: The value of the ChallengeAnswer.challengeId

Connector

In OBP, most internal functions / methods can have different implementations which follow the same interface.

These functions are called connector methods and their implementations.

The default implementation of the connector is the "mapped" connector.

It's called "mapped" because the default datasource on OBP is a relational database, and access to that database is always done through an Object-Relational Mapper (ORM) called Mapper (from a framework we use called Liftweb).

[=============] [============] [============] [.............] [ ] [ ] [...OBP API...] ===> OBP Endpoints call connector functions (aka methods) ===> [ Connector ] ===> [ Database ] [.............] The default implementation is called "Mapped" [ (Mapped) ] [ (Adapter) ] [=============] The Mapped Connector talks to a Database [============] [============]

However, there are multiple available connector implementations - and you can also mix and create your own.|

E.g. RabbitMq

[=============] [============] [============] [============] [============] [ ] [ ] [ ] [ ] [ ] [ OBP API ] ===> RabbitMq Connector ===> [ RabbitMq ] ===> [ RabbitMq ] [ OBP RabbitMq] ===> [ CBS ] [ ] Puts OBP Messages [ Connector ] [ Cluster ] [ Adapter ] [ ] [=============] onto a RabbitMq [============] [============] [============] [============]

You can mix and match them using the Star connector and you can write your own in Scala. You can also write Adapters in any language which respond to messages sent by the connector.

we use the term "Connector" to mean the Scala/Java/Other JVM code in OBP that connects directly or indirectly to the systems of record i.e. the Core Banking Systems, Payment Systems and Databases.

A "Direct Connector" is considered to be one that talks directly to the system of record or existing service layer.

i.e. API -> Connector -> CBS

An "Indirect Connector" is considered one which pairs with an Adapter which in turn talks to the system of record or service layer.

i.e. API -> Connector -> Adapter -> CBS

The advantage of a Direct connector is that its perhaps simpler. The disadvantage is that you have to code in a JVM language, understand a bit about OBP internals and a bit of Scala.

The advantage of the Indirect Connector is that you can write the Adapter in any language and the Connector and Adapter are decoupled (you just have to respect the Outbound / Inbound message format).

The default Connector in OBP is a Direct Connector called "mapped". It is called the "mapped" connector because it talks directly to the OBP database (Postgres, MySQL, Oracle, MSSQL etc.) via the Liftweb ORM which is called Mapper.

If you want to create your own (Direct) Connector you can fork any of the connectors within OBP.

There is a special Connector called the Star Connector which can use functions from all the normal connectors.

Using the Star Connector we can dynamically reroute function calls to different Connectors per function per bank_id.

The OBP API Manager has a GUI to manage this or you can use the OBP Method Routing APIs to set destinations for each function call.

Note: We generate the source code for individual connectors automatically.

Connector Method

Developers can override all the existing Connector methods.

This function needs to be used together with the Method Routing.

When we set "connector = internal", then the developer can call their own method body at API level.

For example, the GetBanks endpoint calls the connector "getBanks" method. Then, developers can use these endpoints to modify the business logic in the getBanks method body.

The following videos are available:

* Introduction for Connector Method

* Introduction 2 for Connector Method

ConnectorMethod.connectorMethodId

Example value: ace0352a-9a0f-4bfa-b30b-9003aa467f51

Description: A string that MUST uniquely identify the connector method on this OBP instance, can be used in all cache.

Consent

Consents provide a mechanism through which a resource owner (e.g. a customer) can grant a third party certain access to their resources.

The following are important considerations in Consent flows:

1) The privacy of the resource owner (the Customer or User) should be preserved.

This means that when a TPP first asks a User if they would like to provide their data, the user should not be authenticated.

Thus the start of the Consent process authenticates the Client (TPP) but not the User.

Authentication of the user comes later.

This endpoint initiates a consent in OBP

2) Consent finalisation often involves SCA.

Since a consent gives its holder privileges on the API, we need to make sure it is not created lightly, therefore some second factor of authentication is employed.

This endpoint finalises an OBP consent

3) A User should be able to list and revoke their consents.

This endpoint lists consents for the authenticated user.

This endpoint revokes a consent for the current user.

This gives the user visibility over the consents they have granted to various apps for various purposes and confidence they can stop the TPP acting for a certain purpose.

4) The consent manager should be able to list and revoke consents.

This is a management endpoint lists consents with various query parameters

This is a management endpoint to revoke a consent

The consent manager may want to list the consents by each Client or User and the ability to revoke individual consents (rather than disabling a client completely).

This requires that the resource server stores the CONSENT_ID and other information so that it can be disabled or queried.

However, the consent manager should not be able to see the CONSENT_ID since this would make it easier to actually use it.

5) A consent is bound to the application has created it.

The User gave consent to a certain application not any application.

6) The consent will have a limited life time.

The consent can become valid in the future and need not last forever.

7) The consent will be signed using JWT.

This increases the security of the claims contained in the consent.

See here for an example flow.

See here for more information about onboarding.

Consent_Account_Onboarding

Consent, or Account onboarding, is the process by which the account owner gives permission for their account(s) to be accessible to the API endpoints.

In OBP, the account, transaction and payment APIs are all guarded by Account Views - with one exception, the account holders endpoint which can be used to

bootstrap account on-boarding.

Note: the account holders endpoint is generally made available only to the Account Onboarding App, so if a View does not exist, no API access to the account is possible.

Consent or Account onboarding can be managed in one of two ways:

1) A backend system (CBS or other) is the system of record for User Consent, and OBP mirrors this.

In this case:

a) OBP requires the CBS or other backend system to return a list of accounts and permissions associated with a User.

b) At User login, OBP automatically creates one or more Views for that User based on the permissions supplied by the CBS.

2) OBP is the system of record for User Consent.

In this case:

a) OBP requires the CBS, Gateway or other system to provide just a basic list of accounts owned by the User.

b) The Onboarding App or Bank's Onboarding Page then authenticates the User and calls the Create View endpoint.

c) The account, transaction and payment API endpoints then work as moderated by the relevant View permissions.

d) The User can revoke access by calling the delete View endpoint.

In summary:

Prior to Views being created on an Account for a User, only the 'accounts held' endpoint will work for the account holder, and this endpoint only provides enough information

to identify the account so it can be selected and on-boarded into the API.

Once a View exists for an Account, a User can interact with the Account via the API based on permissions defined in the View.

Consent_OBP_Flow_Example

1) Call endpoint Create Consent Request using application access (Client Credentials)

Url: https://apisandbox.openbankproject.com/obp/v5.0.0/consumer/consent-requests

Post body:

{

"everything": false,

"account_access": [],

"entitlements": [

{

"bank_id": "gh.29.uk.x",

"role_name": "CanGetCustomersAtOneBank"

}

],

"email": "marko@tesobe.com"

}

Output:

{

"consent_request_id":"bc0209bd-bdbe-4329-b953-d92d17d733f4",

"payload":{

"everything":false,

"account_access":[],

"entitlements":[{

"bank_id":"gh.29.uk.x",

"role_name":"CanGetCustomersAtOneBank"

}],

"email":"marko@tesobe.com"

},

"consumer_id":"0b34068b-cb22-489a-b1ee-9f49347b3346"

}

2) Call endpoint Create Consent By CONSENT_REQUEST_ID (SMS) with logged on user

Output:

{

"consent_id":"155f86b2-247f-4702-a7b2-671f2c3303b6",

"jwt":"eyJhbGciOiJIUzI1NiJ9.eyJlbnRpdGxlbWVudHMiOlt7InJvbGVfbmFtZSI6IkNhbkdldEN1c3RvbWVyIiwiYmFua19pZCI6ImdoLjI5LnVrLngifV0sImNyZWF0ZWRCeVVzZXJJZCI6ImFiNjUzOWE5LWIxMDUtNDQ4OS1hODgzLTBhZDhkNmM2MTY1NyIsInN1YiI6IjU3NGY4OGU5LTE5NDktNDQwNy05NTMwLTA0MzM3MTU5YzU2NiIsImF1ZCI6IjFhMTA0NjNiLTc4NTYtNDU4ZC1hZGI2LTViNTk1OGY1NmIxZiIsIm5iZiI6MTY2OTg5NDU5OSwiaXNzIjoiaHR0cDpcL1wvMTI3LjAuMC4xOjgwODAiLCJleHAiOjE2Njk4OTgxOTksImlhdCI6MTY2OTg5NDU5OSwianRpIjoiMTU1Zjg2YjItMjQ3Zi00NzAyLWE3YjItNjcxZjJjMzMwM2I2Iiwidmlld3MiOltdfQ.lLbn9BtgKvgAcb07if12SaEyPAKgXOEmr6x3Y5pU-vE",

"status":"INITIATED",

"consent_request_id":"bc0209bd-bdbe-4329-b953-d92d17d733f4"

}

3) We receive the SCA message via SMS

Your consent challenge : 29131491, Application: Any application

4) Call endpoint Answer Consent Challenge with logged on user

Url: https://apisandbox.openbankproject.com/obp/v5.0.0/banks/gh.29.uk.x/consents/155f86b2-247f-4702-a7b2-671f2c3303b6/challenge

Post body:

{

"answer": "29131491"

}

Output:

{

"consent_id":"155f86b2-247f-4702-a7b2-671f2c3303b6",

"jwt":"eyJhbGciOiJIUzI1NiJ9.eyJlbnRpdGxlbWVudHMiOlt7InJvbGVfbmFtZSI6IkNhbkdldEN1c3RvbWVyIiwiYmFua19pZCI6ImdoLjI5LnVrLngifV0sImNyZWF0ZWRCeVVzZXJJZCI6ImFiNjUzOWE5LWIxMDUtNDQ4OS1hODgzLTBhZDhkNmM2MTY1NyIsInN1YiI6IjU3NGY4OGU5LTE5NDktNDQwNy05NTMwLTA0MzM3MTU5YzU2NiIsImF1ZCI6IjFhMTA0NjNiLTc4NTYtNDU4ZC1hZGI2LTViNTk1OGY1NmIxZiIsIm5iZiI6MTY2OTg5NDU5OSwiaXNzIjoiaHR0cDpcL1wvMTI3LjAuMC4xOjgwODAiLCJleHAiOjE2Njk4OTgxOTksImlhdCI6MTY2OTg5NDU5OSwianRpIjoiMTU1Zjg2YjItMjQ3Zi00NzAyLWE3YjItNjcxZjJjMzMwM2I2Iiwidmlld3MiOltdfQ.lLbn9BtgKvgAcb07if12SaEyPAKgXOEmr6x3Y5pU-vE",

"status":"ACCEPTED"

}

5) Call endpoint Get Customer by CUSTOMER_ID with Consent Header

Request Header:

Consent-JWT:eyJhbGciOiJIUzI1NiJ9.eyJlbnRpdGxlbWVudHMiOlt7InJvbGVfbmFtZSI6IkNhbkdldEN1c3RvbWVyIiwiYmFua19pZCI6ImdoLjI5LnVrLngifV0sImNyZWF0ZWRCeVVzZXJJZCI6ImFiNjUzOWE5LWIxMDUtNDQ4OS1hODgzLTBhZDhkNmM2MTY1NyIsInN1YiI6IjU3NGY4OGU5LTE5NDktNDQwNy05NTMwLTA0MzM3MTU5YzU2NiIsImF1ZCI6IjFhMTA0NjNiLTc4NTYtNDU4ZC1hZGI2LTViNTk1OGY1NmIxZiIsIm5iZiI6MTY2OTg5NDU5OSwiaXNzIjoiaHR0cDpcL1wvMTI3LjAuMC4xOjgwODAiLCJleHAiOjE2Njk4OTgxOTksImlhdCI6MTY2OTg5NDU5OSwianRpIjoiMTU1Zjg2YjItMjQ3Zi00NzAyLWE3YjItNjcxZjJjMzMwM2I2Iiwidmlld3MiOltdfQ.lLbn9BtgKvgAcb07if12SaEyPAKgXOEmr6x3Y5pU-

Output:

{

"bank_id":"gh.29.uk.x",

"customer_id":"a9c8bea0-4f03-4762-8f27-4b463bb50a93",

"customer_number":"0908977830011-#2",

"legal_name":"NONE",

"mobile_phone_number":"+3816319549071",

"email":"marko@tesobe.com1",

"face_image":{

"url":"www.openbankproject",

"date":"2017-09-18T22:00:00Z"

},

"date_of_birth":"2017-09-18T22:00:00Z",

"relationship_status":"Single",

"dependants":5,

"dob_of_dependants":[],

"credit_rating":{

"rating":"3",

"source":"OBP"

},

"credit_limit":{

"currency":"EUR",

"amount":"10001"

},

"highest_education_attained":"Bachelor’s Degree",

"employment_status":"Employed",

"kyc_status":true,

"last_ok_date":"2017-09-18T22:00:00Z",

"title":null,

"branch_id":"3210",

"name_suffix":null,

"customer_attributes":[]

}

Consumer

The "consumer" of the API, i.e. the web, mobile or serverside "App" that calls on the OBP API on behalf of the end user (or system).

Each Consumer has a consumer key and secret which allows it to enter into secure communication with the API server.

A Consumer is given a Consumer ID (a UUID) which appears in logs and messages to the backend.

A Consumer may be pinned to an mTLS certificate i.e. the consumer record in the database is given a field which matches the PEM representation of the certificate.

After pinning, the consumer must present the certificate in all communication with the server.

There is a one to one relationship between a Consumer and its certificate. i.e. OBP does not (currently) store the history of certificates bound to a Consumer. If a certificate expires, the third party provider (TPP) must generate a new consumer using a new certificate. In this case, related resources such as rate limits and scopes must be copied from the old consumer to the new consumer. In the future, OBP may store multiple certificates for a consumer, but a certificate will always identify only one consumer record.

Consumer, Consent, Transport and Payload Security

Consumer, Consent, Transport and Payload Security with MTLS and JWS

This glossary item aims to give an overview of how the communication between an Application and the OBP API server is secured with Consents, Consumer records, MTLs and JWS.

It includes some implementation step notes for the Application developer.

The following components are required:

Consumer record

The Application must have an active API Consumer / Client record on the server.

MTLS

With Mutual TLS both the Consumer and the Server (OBP API) must use certificates.

JWS

The Request is signed by the Consumer with a JWS using the client certificate of the Consumer. Example: OBP-Hola private void requestIntercept

The Request is verified by the OBP API Server using the JWS provided by the Consumer. See OBP-API def verifySignedRequest

The Response is signed by the OBP API Server with a JWS. See OBP-API def signResponse

The Response is verified by the Client using the JWS provided by the OBP API Server. Example: OBP-Hola private void responseIntercept

Consent

The end user must give permission to the Application in order for the Application to see his/her account and transaction data.

In order to get an App / Consumer key

Sign up or login as a developer.

Register your App / Consumer HERE

Be sure to enter your Client Certificate in the registration form. To create the user.crt file see HERE

Authenticate

To test the service your App will need to authenticate using OAuth2.

You can use the OBP Hola App as an example / starting point for your App.

Consumer.consumer_key (Consumer Key)

The client identifier issued to the client during the registration process. It is a unique string representing the registration information provided by the client.

At the time the consumer_key was introduced OAuth 1.0a was only available. The OAuth 2.0 counterpart for this value is client_id

Consumption Device (CD)

The Consumption Device is the device that helps the user consume the service. In the CIBA use case, the user is not necessarily in control of the CD. For example, the CD may be in the control of an RP agent (e.g. at a bank teller) or might be a device controlled by the RP (e.g. a petrol pump)|

Counterparties

In OBP, there are two types of Counterparty:

-

Explicit Counterparties are created by calling an OBP endpoint - mainly for the purpose of creating a payment or variable recurring payments (VRPs) via Transaction Requests.

-

Implicit Counterparties (or "Other Accounts") are generated automatically from transactions - mainly for the purpose of tagging or adding other metadata.

Counterparties always bound to a "View" on an Account. In this way, different managers of an account can use different sets of beneficiaries.

Counterparties can be thought of the other side of of a transaction i.e. the other account or other party.

Common fields in a Counterparty are:

-

id : A UUID which references it.

-

name : the human readable name (e.g. Piano teacher)

-

description : the human readable name (e.g. Piano teacher)

-

currency : account currency (e.g. EUR, GBP, USD, ...)

-

other_bank_routing_scheme : eg: 'OBP', 'BIC', 'bankCode' etc

-

other_bank_routing_address : eg:

gh.29.uk- it must be a valid example of the scheme and may be validated for existance. -

other_account_routing_scheme : eg: 'OBP', 'IBAN', 'AccountNumber' etc.

-

other_account_routing_address : eg:

1d65db7c-a7b2-4839-af41-95- a valid example of the scheme which may be validated for existance.

The above fields describe how the backend can route payments to the counterparty.

Alternative routings might be useful as well:

-

other_account_secondary_routing_scheme : An alternative routing scheme

-

other_account_secondary_routing_address : If it is an IBAN value, it should be unique for each counterparty.

-

other_branch_routing_scheme : eg: OBP or other branch scheme

-

other_branch_routing_address : eg: `branch-id-123. Unlikely to be used in sandbox mode.

In order to send payments to a counterparty:

- is_beneficiary : must be set to

true

If the backend wants to transmit other information we can use:

- bespoke: A list of key-value pairs can be added to the counterparty.

Note: In order to add a Counterparty to a View, the view must have the canAddCounterparty permission

Counterparties may have Limits have setup for them which constrain payments made to them through Variable Recurring Payments (VRP).

Counterparty-Limits

Counterparty Limits can be used to restrict payment (Transaction Request) amounts and frequencies (per month, year, total) that can be made to a Counterparty (Beneficiary).

Counterparty Limits can be used to limit both single or repeated payments (VRPs) to a Counterparty Beneficiary.

Counterparty Limits reference a counterparty_id (a UUID) rather an an IBAN or Account Number.

This means it is possible to have multiple Counterparties that refer to the same external bank account.

In other words, a Counterparty Limit restricts an OBP Counterparty rather than a certain IBAN or other Bank Account Number.

Since Counterparties are bound to OBP Views it is possible to create similar Counterparties used by different Views. This is by design i.e. a Two Users called Accountant1 could Accountant2 could create their own Views and Counterparties referencing the same corporation but still have their own limits say for different cost centers.

To manually create and use a Counterparty Limit via a Consent for Variable Recurring Payments (VRP) you would:

1) Create a Custom View named e.g. VRP1.

2) Place a Beneficiary Counterparty on that view.

3) Add Counterparty Limits for that Counterparty.

4) Generate a Consent containing the bank, account and view (e.g. VRP1)

5) Let the App use the consent to trigger Transaction Requests.

However, you can use the following endpoint to automate the above steps.

Counterparty.counterpartyId

Example value: 9fg8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: The Counterparty ID used in URLs. This SHOULD NOT be a name of a Counterparty.

Counterparty.counterpartyName

Example value: John Smith Ltd.

Description: The name of a Counterparty. Ideally unique for an Account

Counterparty.isBeneficiary

Example value: false

Description: This is a boolean. True if the originAccount can send money to the Counterparty

Cross-Device Authorization

Cross-device authorization flows enable a user to initiate an authorization flow on one device

(the Consumption Device) and then use a second, personally trusted, device (Authorization Device) to

authorize the Consumption Device to access a resource (e.g., access to a service).

Two examples of popular cross-device authorization flows are:

- The Device Authorization Grant RFC8628

- Client-Initiated Backchannel Authentication CIBA

Customer

The legal entity that has the relationship to the bank. Customers are linked to Users via User Customer Links. Customer attributes include Date of Birth, Customer Number etc.

Customer.attributeId

Example value: 7uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: Customer attribute id

Customer.attributeId

Example value: 7uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: User attribute id

Customer.consumerId

Example value: 7uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: A non human friendly string that identifies the consumer. It is the app which calls the apis

Customer.customerAccountLinkId

Example value: xyz8a7e4-6d02-40e3-a129-0b2bf89de8uh